SCRYPT Partners with Gauntlet to Unlock Swiss-Licensed DeFi for Institutions

Built for Execution. Licensed to Deliver

Your Crypto Edge

SCRYPT is the crypto partner behind firms entering or scaling their digital asset strategy

$0B+

In Volume

as of June 2025

0+

Licensing & Supervision

0+

in 40+ Jurisdictions

Trusted Institutional Clients

0/7

Trading, Support & Settlement

Solutions

What We Offer

Institutional infrastructure, built for execution

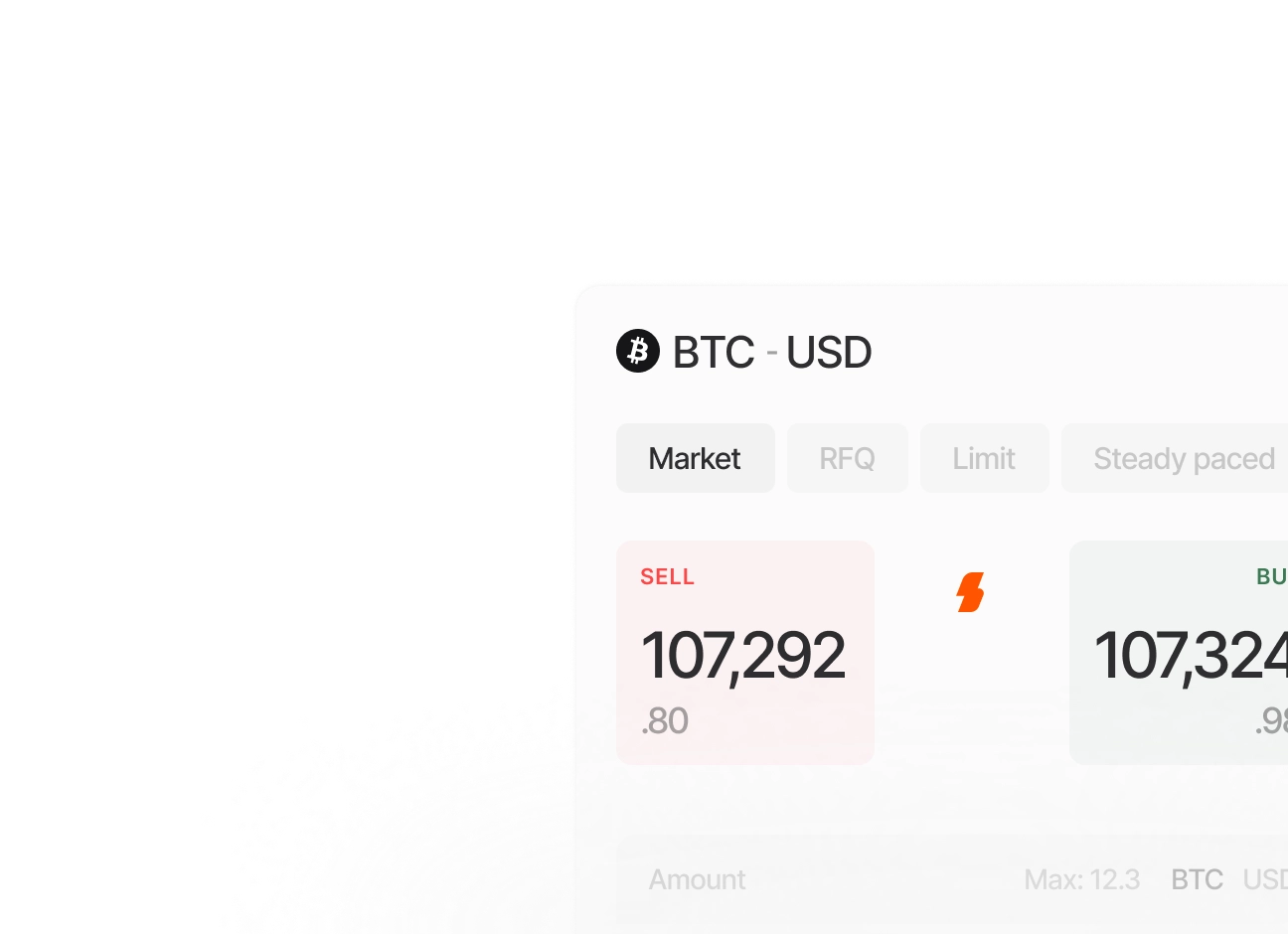

24/7 Execution

Trading

TradingTrading

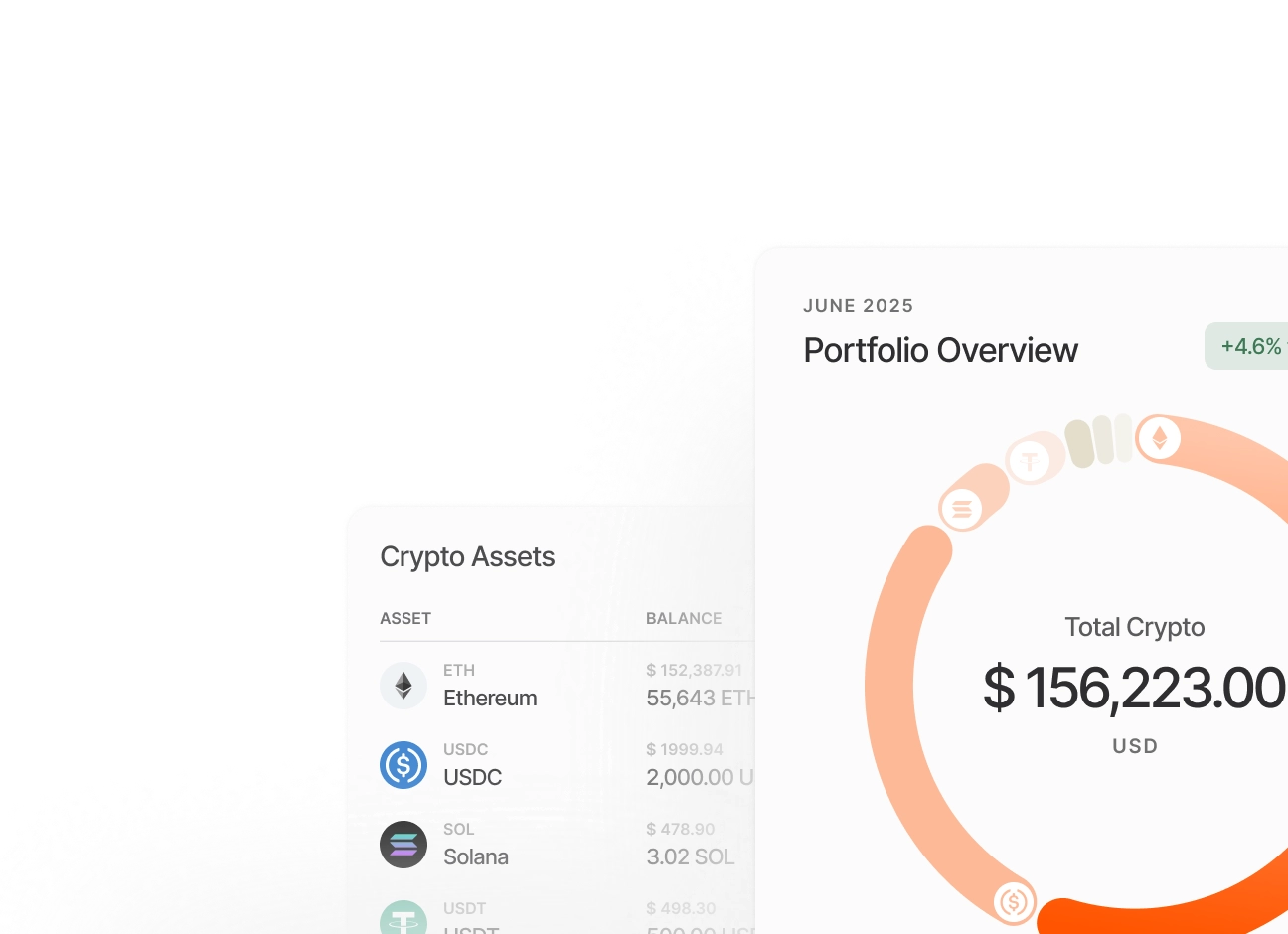

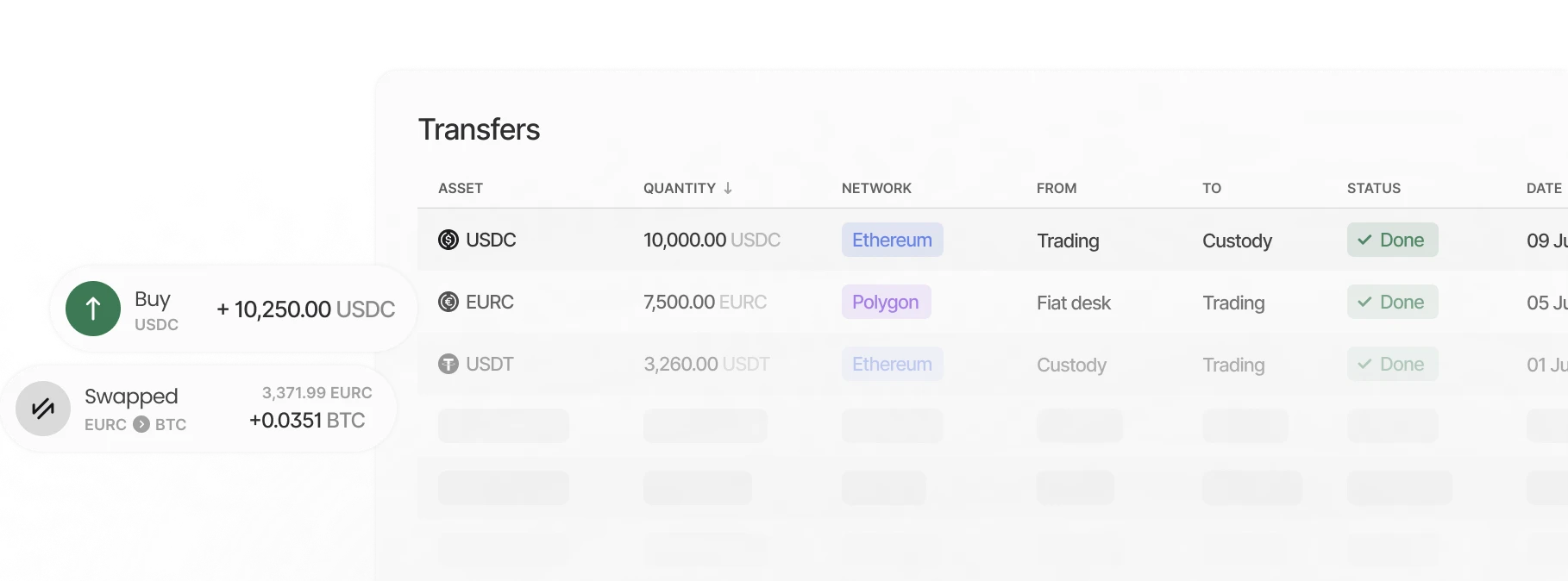

Trade, monitor and settle crypto assets 24/7 with deep liquidity, leading FX, stablecoin rails, and seamless UI & API access

Deep Liquidity Access

OTC & Spot Trading

Instant Conversions

Stablecoin Access

Secure Vault

Bespoke Strategies

Why scrypt

The Swiss Standard for Digital Assets

Across execution, coverage & service - we’re built to move as fast as you do

Trusted by institutions worldwide

Global Solutions

Launch Your Crypto Strategy with SCRYPT

Who We Serve

Powering the Firms

Shaping the Future of Finance

SCRYPT delivers execution you can trust with people you can count on

Testimonials

What Our Clients Say

01/07

Resources

Latest insights

Explore a range of crypto insights, from in-depth case studies to the latest market news, podcasts, and key announcements